30,000 Qantas or Amplify Points on St Amplify Platinum/Signature Credit Card (0 Annual

Complimentary Insurances Please note that there are terms, limits, conditions and exclusions that apply. See the Credit Card Complimentary Insurance Terms and Conditions (PDF 1MB) for eligibility details and for more information about epidemics and pandemic coverage (such as COVID-19), please read the Allianz Global Assistance FAQs

St Amplify Rewards Platinum 100k Bonus Points 3k+ Spend 90 Days + 27.50/month Cashback

Apply for the St.George Amplify Qantas Platinum credit card by 30 April 2024, and spend $3,000 or more on eligible purchases + within 90 days from card approval to receive 60,000 bonus Qantas Points *. Bonus points plus more 0.5 Qantas Points per $1 spent on eligble purcashes +, up to $100,000 each year ^

Amplify Rewards

The St. George Amplify Platinum Credit Card gives you the chance to earn 1 Amplify Point per $1 spent on Visa (uncapped) when you opt for the Amplify Rewards option, or 0.5 points per dollar spent on Visa when you go with the Qantas Frequent Flyer option.

Amplify Qantas Platinum Card 0 1st Year Fee for Existing Customer, Save 99 (+ Bonus

St.George Amplify Platinum Credit Card - Qantas. With the St.George Amplify Platinum card you can for a limited time get 60,000 bonus Qantas points when you apply by 30 April 2024 and spend at least $3,000 within 90 days from card approval. Earn 0.5 Qantas Points per $1 spent* plus get a discount on the annual fee the first year.

Amplify Rewards

Amplify Rewards is the St.George rewards program that earns you uncapped points on everyday eligible purchases. You can redeem them for a wide range of retail gift cards, popular products, travel options (including redeeming for frequent flyer points with Singapore Airlines and Virgin Australia), or even donate to one of our listed charities.

St. Bank Amplify Platinum Review Travel insurance reviews credit card

Why? Key rates & fees Before you apply Apply now Quick snapshot Earn Amplify Points with every eligible purchase, and enjoy a range of complimentary insurances. New cards only. See below for standard rates and fees. Amplify Rewards Platinum offer 100K Bonus Amplify Points

St Amplify Credit Card Review Points Brotherhood

The St.George Amplify Platinum is a rewards credit card that earns 1 point per $1 on eligible spending. It also offers 100,000 bonus Amplify Points when you apply as a new cardholder by 30 April 2024 and spend $3,000 on eligible purchases in the first 90 days from card approval.

Amplify Rewards Credit Card Point Hacks

St.George Amplify Platinum Credit Card Updated 14 November 2023 Receive 100,000 bonus Amplify Points (worth up to $450 in eGift cards) when you apply by 6 November 2023 and spend $3,000 on eligible purchases in the first 90 days from new card approval.

Amplify Qantas Platinum Point Hacks

Who can apply for an Amplify Card? How do I apply for an Amplify Card? I already hold a St.George credit card. How do I switch to Amplify? How do I link my Amplify Card to my Qantas Frequent Flyer membership number? What if I'm not already a Qantas Frequent Flyer program member? Can I switch between rewards programs?

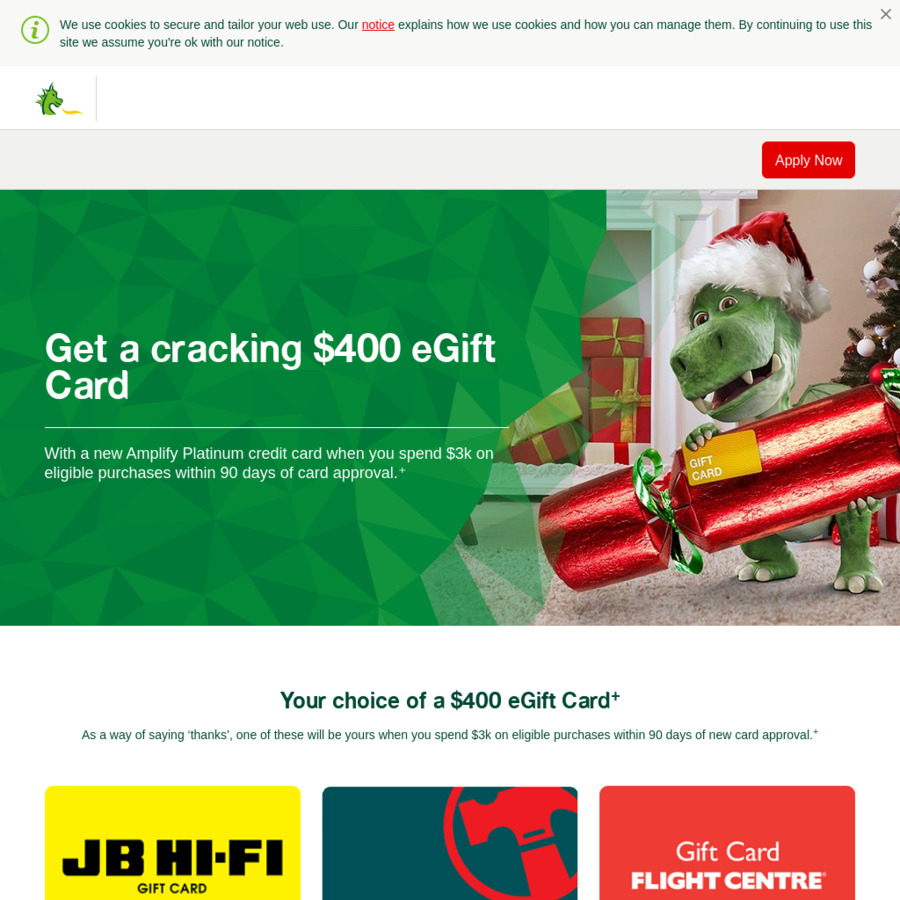

Amplify Platinum Credit Card 400 Gift Card (Various Retailers) with 3000/90 Day Spend St

Reward Program Your guide to the Amplify Rewards credit card program Here's your guide to earning and maximising reward points on St.George, Bank of Melbourne and BankSA Amplify credit cards. By Staff Writers, June 18 2020 Disclaimer Executive Traveller may receive a commission when you apply for these credit cards via our links.

Review Amplify Signature Visa credit card review [2023] Executive Traveller

Credit Card Review: St.George Amplify Platinum Visa card Take home 90,000 bonus Amplify Points when you apply and spend $3,000 within 90 days. Overall Rating By Staff Writers, February 19 2022 Grade/tier: Platinum Card type: Visa Loyalty variants: Amplify Qantas (Qantas Points) or Amplify Rewards (Amplify Points).

Earn Qantas Points with

5 reviews · Statistics Positive vs Negative 40% · 2 3 · 60% Write a review Details Q&A Compare Transparency 2.0 (5) Customer Service 2.0 (5) Rates and Fees 3.0 (4) Rewards 3.3 (4) Online Experience 3.0 (4) Application Process 1.6 (5) Earn 1 Amplify Point or 0.5 Qantas Points per $1 spent on eligible purchases

No Annual Fee Bank

Card Overview The St.George Amplify Qantas Platinum has 60,000 bonus Qantas Points on offer for new cardholders. Includes 0% p.a. for 24 months on Balance Transfer plus a range of complimentary insurances with a $124 annual fee. Key Attributes 60,000 Qantas Points, when you spend $3,000 on eligible purchases within the first 3 months of approval

Your guide to the Amplify Rewards credit card program (2023)

St.George is offering 150,000 Amplify Rewards Points (equivalent to 75,000 Velocity Points or up to $675 in eGift cards) plus a reduced first-year annual fee of $199 for new cardholders who apply for the Amplify Rewards Signature Visa Card variant by 30 April 2024 and spend a minimum of $12,000 on eligible purchases within the first 12 months from approval.

Amplify Rewards

Existing customers who currently hold an Amplify, Amplify Platinum or Amplify Signature card issued by St.George, Bank of Melbourne or BankSA, or who have held one in the last 12 months, are not eligible for this offer. The bonus Amplify Points will be added to your points balance within 12 weeks of the eligible spend criteria being met.

St of Melbourne/Bank SA Amplify Platinum Card 60k Qantas Points 49 Annual Fee

St.George is offering 100,000 bonus Amplify Points (can get you up to $450 in eGift cards) and a reduced first-year card fee of $49 for new cardholders of the Amplify Platinum Visa - Amplify Rewards until 30 April 2024. Plus 0% p.a. on Balance Transfers for 24 months with a 1% BT fee. A minimum spend of $3,000 or more within 90 days of.